Author: Jenny Pearce / June 13, 2019

Over recent years there have been numerous changes to pensions and in particular to the annual allowance and not for the better!

The benefit of topping up your pension with unused allowances from previous years are often overlooked. Utilising these allowances is often the cornerstone of our recommendations.

What is the annual allowance?

In essence the annual allowance places a cap on the amount you can contribute into your pension each year, on which you can receive tax relief. For the 2019/20 tax year the annual allowance has been set at £40,000 (this is dependent on your level of income). I am deliberately over simplifying matters here since the £40,000 allowance is reduced by £2 for every £1 your total income is over £150,000, reducing ultimately to £10,000.

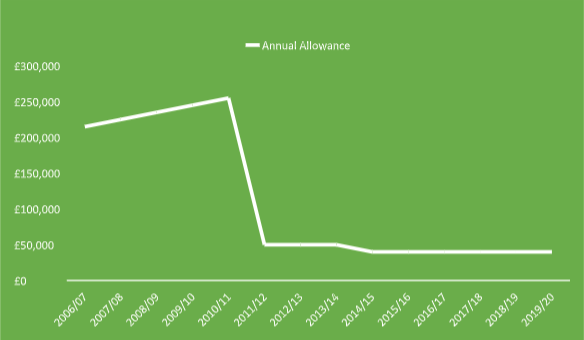

Annual allowance over the years

Over the past 11 years the government has significantly reduced the annual allowance.

You can see the trend from the chart below.

What counts towards pension annual allowance?

All contributions made by you or your employer utilise part or all of your annual allowance.

Carry forward rules

Carry forward rules allow any unused annual allowances to be carried forward

from previous tax years. The main rules of carry forward are as follows:

- You must be a member of a registered pension scheme in which your

unused allowance would be carried forward from. Although you do not

have to have contributed. - You must fully utilise the allowance for the current tax year first, before

carrying forward previous years. - Your contribution cannot exceed your remuneration in the current tax

year. Different rules can apply for Company Directors.

In summary I believe with the possibility of a Corbyn administration you should make use of all allowances available, they might be attacked. The deadline to carry forward your unused 2016/17 allowance is 5 April 2020.

If you would like to discuss this further, please contact us and we would be more than happy to help.